The Four Pillars of an Optimally Structured Portfolio

- Successful investment strategies are long term and strategic, but should be adjusted tactically based on shifts in market cycles

- Diversification through asset allocation is essential

- Tax efficiency is a critical component of success

- Implementation of appropriate investment vehicles combined with sensitivity to fees.

LONG TERM INVESTMENT STRATEGY

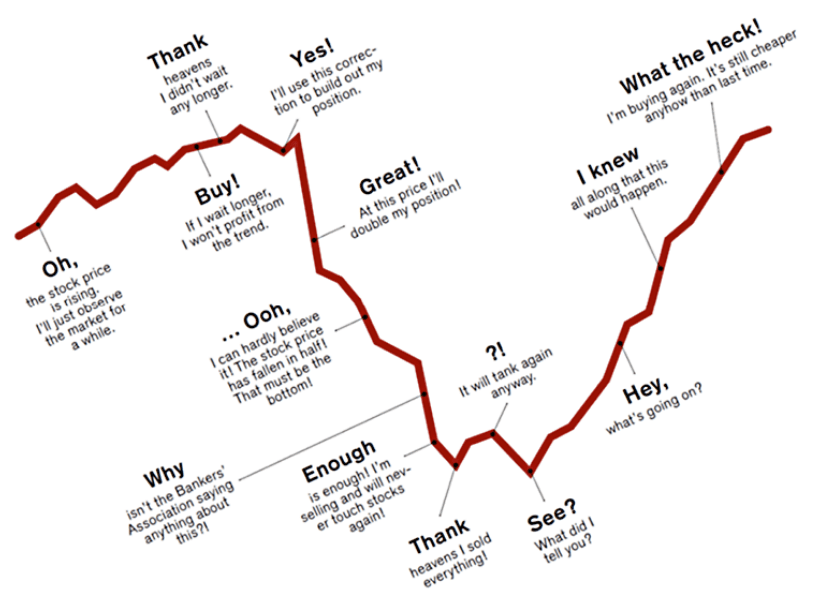

Developing and adhering to a long term investment strategy based on a comprehensive, strategic plan is the first step in achieving your financial goals. Your stage in life, risk tolerance, lifestyle needs, tax situation, and family responsibilities are but a few of the factors that must be considered in building a personally customized strategy. Through the financial planning process, we have compiled the needed information that allows us to drive to an ideally balanced investment strategy that optimizes your risk/return profile and maximizes the likelihood of achieving your future financial goals. This long term strategy is your road map to financial success. “Detours” from this road map are typically driven by investor emotionality. The chart below (humorously) illustrates the all-too-common investor emotions:

It is important to understand that there are market cycles for every type of investment. These cycles will offer buying and selling opportunities as well as opportunities to overweight and underweight specific asset classes and risk exposures based on given market conditions. That said, it is critical that these tactical, shorter-term shifts are managed within the context of macro and micro-economic conditions rather than emotional and behavioral reactions to any given event. By eliminating emotions from the equation, investors greatly enhance the likelihood of achieving success.

DIVERSIFICATION

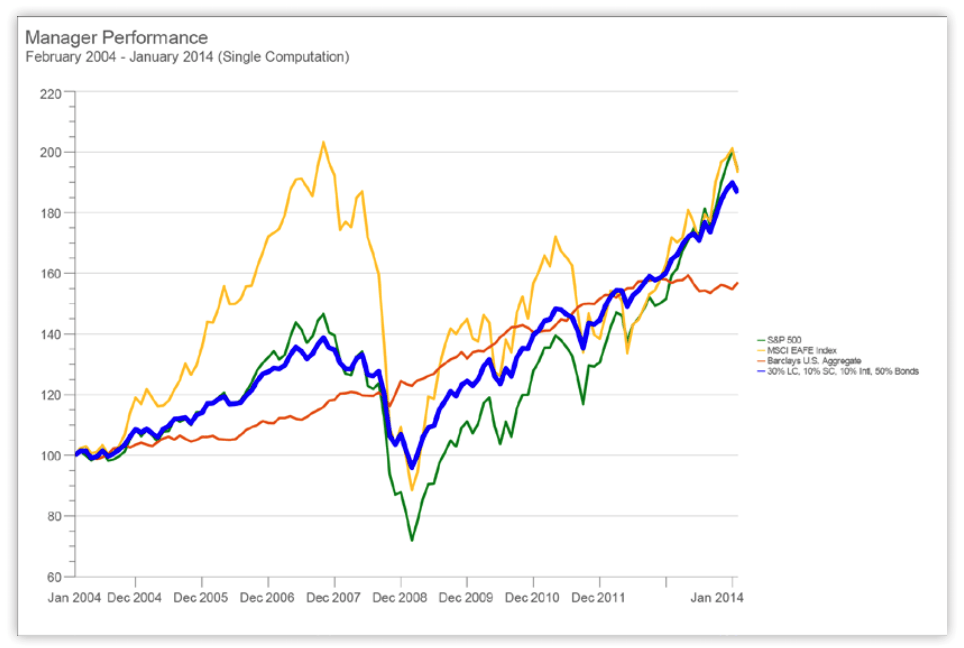

The most important cornerstone of investing is diversification. Simply put, diversification reduces portfolio volatility. When talking about equities, having exposure to multiple styles and sectors can reduce downside risk, while capturing market-like returns over the long term. While a diversified portfolio will always lag the hottest-performing sector, style, or index, it will provide the optimal structure for avoiding devastating downturns. Using diversification will also eliminate the pitfalls of chasing the hot stock or index of the day which typically becomes overvalued and sets the stage for a realized loss tomorrow. It is important to understand that downside protection can have just as large an impact on actual portfolio value as that of upside capture. Remember that losing 50% in a downturn will require a 100% return to simply make up that loss. Thus, limiting any loss during a downturn will make the subsequent upturn mean that much more to the total value and total return of your investments.

At Carnick & Kubik, we focus significant efforts on minimizing downside risk exposure. We utilize appropriate diversification methodology to maximize risk-adjusted return for our clients, while smoothing the level of returns as much as possible. From a long term standpoint, we seek to have equity exposure to all four of the domestic styles (Large Value, Large Growth, Small Value, and Small Growth), as well as all sectors (Technology, Discretionary, Industrials, Health Care, etc.). Additionally, we will utilize international exposures when appropriate. From a tactical, shorter term standpoint, we overweight sectors and styles we feel to be in favor, and underweight those we expect to lag. Regarding diversification and risk reduction within the fixed income markets, our bond analysis includes focused consideration of type of bonds, credit quality, bond structures, duration (or average life of the bonds), and financial strength. These are the key components in building an optimal bond portfolio. Underlying all of Carnick & Kubik’s diversification methodologies is a sophisticated valuation approach focusing on identifying the strongest of individual securities for selection in our portfolios.

TAX EFFICIENCY

Driven by an enormous marketing engine, the investment management arena emphasizes total investment returns continued on next page before taxes, and generally does not focus on the more important after-tax returns. This is a colossal mistake, because what really matters is how much money you’re left with after taxes. To maximize after-tax returns, investment advisors must optimize which assets are held in which types of accounts and what types of securities should be held based on the client’s tax bracket. Additionally, turnover (how often the underlying securities are traded) can impact whether an investor pays long term capital gains taxes or ordinary income taxes on gains. Without a strong tax-efficient investment strategy in place, taxes can erode much of investors’ gains. Consider the following three strategies that are examples of investment tax management:

TAX DEFERRAL – Utilize Qualified Investment Accounts for the Least Tax Efficient Investments Dividends and capital gains receive preferential treatment, and should be considered for investment in taxable accounts. Conversely, taxable bond income can now be taxed as high as 50% if held in taxable accounts. Imagine investing in a bond yielding 6% that only truly delivers 3% after paying taxes. Clearly, holding that same bond in a traditional IRA or Roth IRA will yield much better results due to the tax-deferred (or tax-free, in the case of the Roth) nature of these accounts. There are many other factors to consider when looking at investments, but those who ignore asset location will most likely under-utilize the tax efficiencies created under this new tax environment.

TAX MANAGEMENT – Manage Turnover, Gain/ Loss Harvesting, Distributions, & Gifting The American Taxpayer Relief Act (ATRA) was signed into law by President Obama on January 2, 2013. The Act establishes permanent low tax rates for income, capital gains, and dividends, while creating higher tax rates for income levels above $400,000 and $450,000 for single and married taxpayers respectively. ATRA also establishes phase-outs of deductions and exemptions for the upper income levels. This tax relief act truly delivered a new and complex era in taxation. It replaced the old system of two levels of taxation with five. No longer do we simply worry about AMT tax limits. We must now plan for the possibility of different taxes: income, AMT, investment, Medicare, and deduction thresholds that affect all tax payers. Needless to say this will require focus on both the type of income being generated, as well as the location of asset types. The “Marginal Tax Rates” table at the end of this publication provides a quick summary of the new tax schedules and the investment-related tax numbers that will impact you going forward.

TAX REDUCTION – Consider Tax-Free Investment Strategies and Qualified Dividends Depending on your asset allocation, we may consider utilizing municipal bonds, which can deliver taxfree income altogether. For instance, in a 47% tax environment, a $10,000 investment in a 4.5% taxable bond, compared to a 4% tax-free bond delivers results that dramatically favor the municipal bond. Further, there are various other types of income investments outside of the traditional fixed income class that are now tax-favored. Preferred stocks and MLPs are great examples of income-producing investments that can be taxed efficiently.

INVESTMENT VEHICLES & FEE AWARENESS

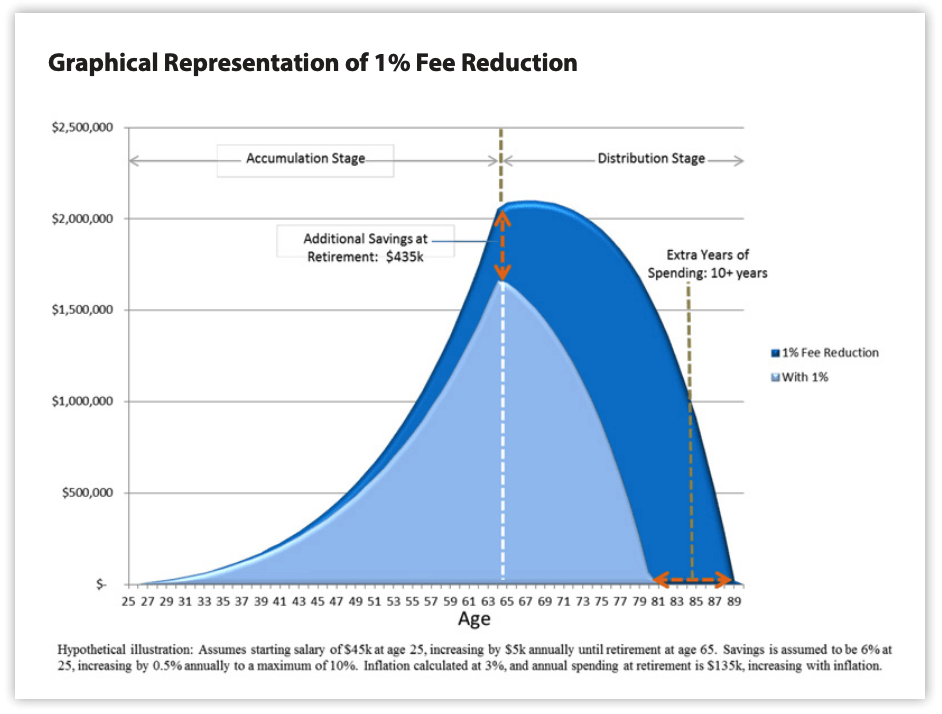

Investment fees are often an overlooked detriment to overall investment performance. When it comes to investment advisors and money managers, there are generally multiple layers of fees, with each layer of management requiring a “piece of the pie.” After eliminating the conflict-ridden, commissionbased deliverables, fee structure and the number of management layers is still a very important factor in overall investment performance. The typical fee-only advisor generally charges a fee on top of that of the underlying money management strategies, often resulting in a total cost of more than 2%.

At Carnick & Kubik, we have built our investment advisory and money management deliverables around eliminating as many of these fees as is possible. The net result is that we often can reduce our clients’ fee expenses by 50%! These fee savings have historically resulted in greater overall investment performance and our clients achieving their financial goals more quickly. Consider the graph at right that shows the impact of 1% fee reduction over a long time period: Ultimately, excessive layers of fees, load mutual funds, and fees that are simply too high, will erode the overall investment strategy’s performance and hinder the investor in achieving their financial goals.