Business Structures and Their Tax Implications

There are many critical decisions to make when deciding to start a business, one of which is choosing the entity type for your business. The type of business structure you select will have numerous implications, such as the amount of paperwork needed to establish and maintain the business, the amount of liability protection that may or may not be offered, and the taxation of the income earned by the business. Here, we will dive into the tax implications of some of the most commonly-used business entities.

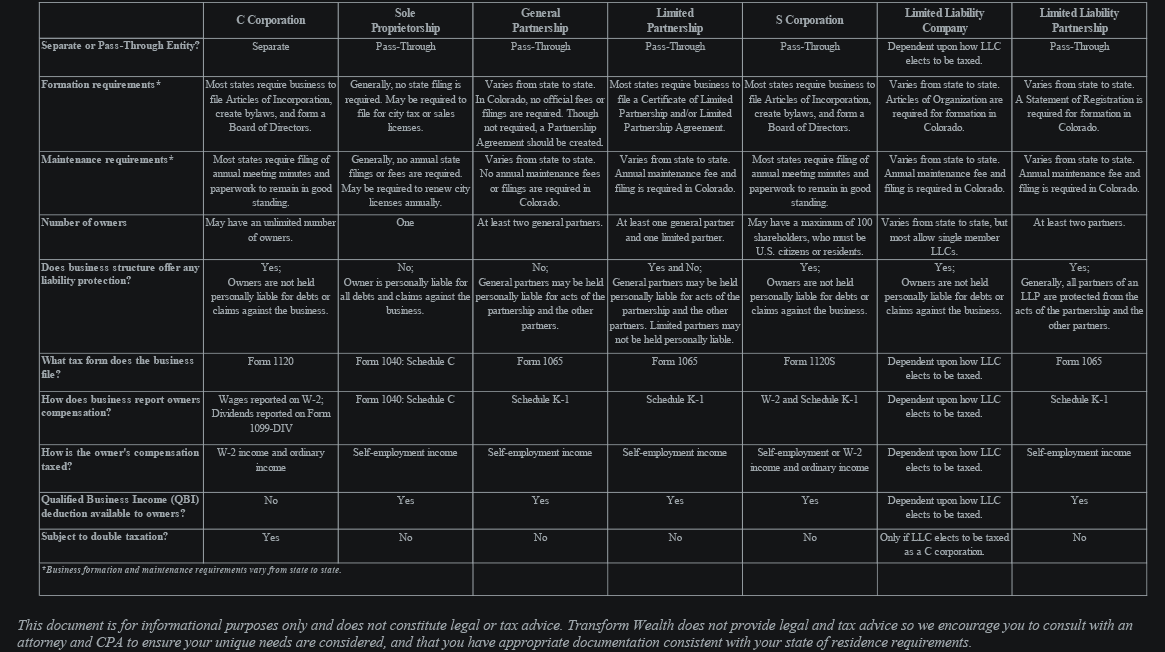

First, it’s important to know the difference between a business that is considered a separate entity and a business considered a pass-through (or “conduit”) entity. A business that is considered a separate tax entity files its own tax return and pays its own taxes. On the other hand, if a business is a pass-through entity, it does not pay its own taxes. Rather, all business income and losses pass through to the business owners. There are several business structures that are considered pass-through entities, including sole proprietorships, partnerships, S corporations, and LLCs.

C Corporation

C corporations are, for both legal and tax purposes, considered separate entities from their owners or shareholders, and are not pass-through entities. This means that the business itself must file a corporate tax return, Form 1120, report all business profits, deductions, and credits on this return, and pay taxes at the corporate level on net corporate income.

One significant disadvantage of C corporations is they may be subject to what is commonly referred to as “double taxation,” where business profits are taxed first at the corporate level, and then at the shareholder level. In 2023, C corporation income is taxed at a rate of 21%. Business profits that are then distributed to shareholders are a taxable event to the shareholder. This is considered to be a major disadvantage of this business structure.

It’s important to point out that owners of C corporations are not eligible for the qualified business income (QBI) deduction, a tax deduction available only for business owners with pass-through business income. This was passed with the Tax Cuts and Jobs Act of 2017 and allows owners to deduct up to 20% of net qualified business income. This deduction is available to owners of sole proprietorships, partnerships, S corporations, and LLCs, and is subject to income limits, and other requirements and rules. While C corps are not eligible for this deduction, there are numerous tax deductions available at the corporate tax level, such as the deduction of salaries and wages, charitable contributions, and the cost of health insurance benefits and fringe benefits.

Another consideration is that C corporations must have a Board of Directors, file various paperwork, and require annual filings and recordkeeping. This makes the initial formation and ongoing management more complex and expensive than other types of business structures. Therefore, a C corporation is usually more appropriate for businesses with a significant amount of revenue. Some advantages of C corporations are that there is no limit to the number of shareholders, or the citizenship or residency of the shareholders. Also, multiple classes of stock can be issued, and stock can be sold if financing is needed. Limited legal and financial liability protection is another benefit of C corporations; as shareholders are only liable for their portion of ownership in business debts and liabilities.

Sole Proprietorship

Sole business owners starting a new business often select the sole proprietorship structure, a pass-through business structure that is not considered a separate entity. All business income, losses, and deductions are reported on Schedule C of the owner’s personal income tax return. If in any given year business income exceeds the business losses, the net business income is subject to self-employment tax, which is calculated on Schedule SE of the owner’s personal income tax return. Currently, self-employment income is taxed at a rate of 15.6%, with half of this tax being deductible to the taxpayer. If business losses exceed business income for a given year, the loss can be used to offset other sources of income, reducing the business owner’s taxable income.

Sole proprietorships are simple to establish, do not require excessive amounts of paperwork, and offer the potential of various tax deductions, such as transportation, health insurance, home office, and other deductions. A disadvantage of the sole proprietorship is the lack of liability protection. With this business structure, the owner is personally liable for all debts and liabilities of the business.

Partnerships

There are two types of partnerships that can be formed; a general partnership and a limited partnership. Both partnership forms are pass-through entities. A general partnership consists of at least two partners who share equally in all assets, liabilities, profits, losses, and management of the business. It is important to note that a general partnership does not offer liability protection, so if the business were to have any legal or financial difficulties, the personal assets of the partners would not be protected.

Since it is a pass-through entity, a general partnership does not pay its own taxes, and all profits and losses pass through to the partners. The business is required to file a Form 1065 partnership tax return, which is an informational return only. Each partner’s share of income and deductions is reported on Schedule K of the partnership’s 1065, and the partnership then distributes a Form K-1 to each partner. The K-1 received by each partner indicates their individual portion of income and deductions, which they then report on Schedule E and SE of their personal tax return. Self-employment taxes are owed on this net income, with half of the self-employment tax being deductible to the taxpayer.

A limited partnership, or LP, is often used with businesses that have at least two partners; one being a partner who is actively involved in the business, known as the “general partner” and one being a partner who is not actively involved in the business, generally an investor, known as the “limited partner.” This business structure is useful if there are some partners who are interested in running the day-to-day operations of the business and some that would like to invest in the company, but avoid day-to-day management. Similar to a general partnership, the general partner of an LP has unlimited liability, which leaves their personal assets unprotected if the business has any legal or financial issues. Limited partners receive limited liability protection up to the amount they invested in the business.

A limited partnership has similar tax implications as a general partnership; it files an informational Form 1065 tax return, and reports each partner’s pro-rata share of business profits and losses, based on their ownership percentages, on a K-1. However, one noteworthy difference is that because limited partners are passive owners, they are subject to passive activity rules. Passive activity rules restrict a limited partner’s ability to deduct losses, as passive losses can only be used to offset passive income. So, if a limited partner incurs a passive loss from the partnership in any given year, these passive losses cannot be used to reduce active or earned income. However, these passive activity losses can be carried forward indefinitely, and used in a future year to offset passive income.

There are some additional differences between general and limited partnerships. The formation of a general partnerships is very informal and does not require a written partnership agreement. Limited partnerships typically require more initial paperwork to be filed with the local Secretary of State’s office, and annual filings and fees required for the business to stay in good standing with the state.

One unique feature of partnerships is the ability to implement special allocations of income, loss, deduction, or gain, that do not correlate to each partner’s actual ownership interest. This can be beneficial to the partners in years of significant gains or losses, as the business can allocate the gains or losses to reduce the amount of taxes each partner will owe. However, the IRS is more likely to scrutinize special allocations, so be sure to understand and follow the specific rules associated with this provision.

S Corporation

An S corporation is a regular corporation that elects to be taxed as a general partnership and obtain pass- through tax treatment. S corps file an informational tax return, Form 1120S, and business income and losses flow through to the shareholders, who then report their proportionate share of income and losses on their personal tax returns. The S corporation divides income and losses between each shareholder based on their ownership percentage and distributes K-1s to each shareholder. There are some specific types of taxes that an S corporation may be required to pay at the corporate level, but unlike C corporations, S corps avoid double taxation on business income.

One advantage of S corporations is that owners receive wages as well as business distributions, and self- employment taxes are owed only on the amount of wages earned. To prevent owners from avoiding self- employment tax entirely by taking $0 in wages, the IRS has a requirement that owners are paid a “reasonable salary,” though there are no strict limits or guidelines on this. This is a significant benefit for S corps owners, as they often incur less income tax than they would with other business entities. Additionally, S corps shareholders can use passthrough losses to offset other sources of income, up to their basis in the business.

An advantage of this entity is the limited liability offered to owners. A disadvantage of this entity, similar to a C corporation, is the amount of paperwork and recordkeeping required, making the establishment and administration of this business structure more costly and time-consuming. Other requirements are that shareholders must be U.S. citizens or residents, there may be no more than 100 shareholders, only one class of stock may be issued, and the company cannot go public.

Limited Liability Company

A limited liability company is a pass-through entity and is not federally recognized as a separate entity for income tax purposes. LLCs must elect to be taxed either as a sole proprietorship, a partnership, a C corporation, or an S corporation. Single member LLCs that choose to be treated as sole proprietorships will be taxed the same way, with all business income reported and taxed on Schedule C of the owner’s personal tax return. LLCs with more than one owner may choose to be taxed as a partnership. In this case, the LLC will file an informational partnership tax return (Form 1065) and provide each owner with a K-1, which they will then use to report their share of income and losses. It is important to recognize that whether an LLC elects taxation as a sole proprietorship or a partnership, the owners will pay self- employment tax on the company’s net profits.

In order for an LLC to elect to be taxed as a C or S corporation, certain requirements must be met. LLCs that elect to be treated as C corps will be treated as separate tax entities and will report income and losses the same as a C corporation would. There are various reasons why an LLC would choose to be taxed as a C corporation, such as to reduce the amount of self-employment taxes owed by the owners, or to retain earnings within the company at a lower tax rate than if they were to flow through to the owners’ personal returns. Owners of LLCs who opt to be taxed as S corps will enjoy the same tax advantages as a regular S corporation, such as self-employment taxes being owed only on their wages, rather than all company profits. No matter how an LLC chooses to be structured, a major advantage of this entity is the limited liability protection offered to its members.

Limited Liability Partnership

The limited liability partnership is a pass-through business structure that can only be formed in states that allow this entity type. Typically, LLPs are seen with businesses that provide a professional service, such as law firms, medical practices, wealth management firms, and accounting firms. Business income and taxes are reported and paid similarly to a general partnership. The LLP must file an informational partnership tax return (Form 1065) and report each partner’s share of income on a K-1. LLP owners must report their pro-rata share of income on their personal tax returns as self-employment income. One major benefit of the LLP structure is that unlike general partnerships and LLCs, all partners of an LLP are protected from the negligence, fraud, or wrongdoing of the other partners. The level of protection offered by the LLP does vary from state to state, so state-specific laws should be verified.

Business Ownership and Financial Planning

For new business owners, it is essential to understand the tax implications of different business structures in order to select the most appropriate entity. For owners with established businesses, frequently-changing tax rules can become difficult to stay on top of or fully understand. On top of tax implications, there are numerous other considerations, including the amount of liability protection offered, the filing requirements, legal implications, and future needs of the business.

For all of these reasons, we recommend working with a tax professional and legal counsel to understand the IRS requirements and legal implications of these various business structures. As part of our comprehensive financial planning process, we will review your business income and taxes, and assess the impact of your business on your personal financial goals.