Transformational Financial Planning

Sometimes, the need for financial planning starts with a major life event like deciding to retire or following the death of a loved one. Other times, it’s an increasing degree of complexity in your financial life that warrants a second set of eyes. And sometimes, it’s just wanting to get started financially on the right foot, and making sure you stay on an appropriate path over time, making adjustments as needed. When you’re ready to start the financial planning process, we’re here to help!

Step 1: Preliminary Planning Discussion

At Transform Wealth, the planning process usually begins with a complimentary initial consultation in which we’ll discuss where you are currently from a financial standpoint, where you hope to be in the future, and whether now is the right time for you to engage us for financial planning. If you’re just looking for a quick snapshot of where you stand, and don’t have the time to commit to a comprehensive financial plan, our Financial Assessment may be the best fit for you. This straightforward analysis provides you with basic net worth and cash flow projections, and is a great starting point in determining where you stand financially. The best part is that you can always move on to comprehensive planning in the future, when it’s the right time for you to do so.

If you need more than a basic snapshot, our comprehensive financial planning services may be the right fit for you. Comprehensive planning begins with significant data-gathering, including the completion of our Client Workbook and submitting substantial supporting documentation. The Workbook is a critical part of our planning process, in that it asks for not only your financial data, but also takes an in-depth look at your goals, how you make decisions from a behavioral finance perspective, and also considers your personal financial history. If you’re a part of a couple, we’ll consider both of your financial backgrounds to ensure our recommendations make sense for you both. The better we understand you and what you’re trying to achieve, the better we can tailor our recommendations to your goals and objectives.

Step 2: Complete Workbook & Document Gathering

When your Workbook has been completed and submitted with your supporting documentation, that’s where our work begins. Our financial planning team will review and analyze your information and ask follow-up questions to ensure we have a clear picture of your financial circumstances. Once we have all of this information, we’ll begin building your comprehensive plan. The plan includes not only cash flow and net worth analysis and projections, but also considers how your asset allocation complements your goals, whether your tax circumstances have room for improvement, whether your risk management strategies are sufficient to cover your risk exposures, and whether your estate plan actually does what you hope it will do in the event of incapacity or death.

All of these various elements of your financial life are interrelated, and are very much dependent upon what you hope to achieve in the years ahead. By looking at the whole picture, and truly understanding where you (and your partner) are coming from, we then make a series of recommendations that will start you down the path to financial transformation.

Step 3: Plan Presentation

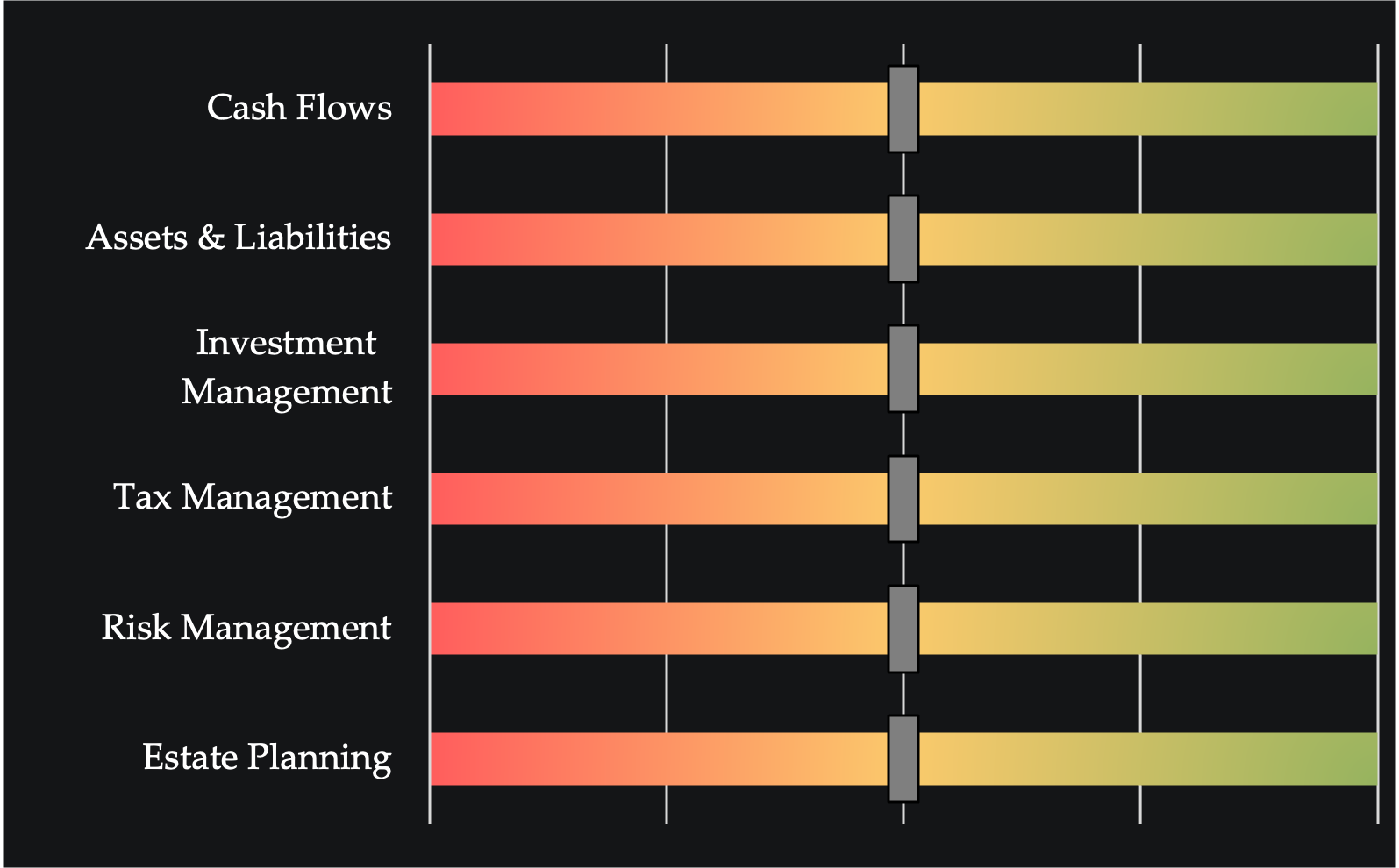

The financial plan presentation is one of the most pivotal parts of the planning process, as this is where we present your plan and make recommendations in all of the various planning areas previously mentioned. In each planning area, we use progress bars to highlight where you stand today, and the plan culminates in a series of recommendations which can help you move toward your goals.

Step 4: Plan Implementation

After the plan is presented, we will support the implementation of your financial plan. This could involve corresponding with your tax preparer, providing guidance when shopping for insurance, or providing your estate planning attorney with the supporting information they need to ensure your estate documents are effective. Annually, we will check in and ensure you continue to progress towards your goals. As I always tell planning clients, “my recommendations are only as good as what you do with them,” so the path to financial transformation involves ongoing, incremental progress. The good news is that we’re here to partner with you the entire way.

Reaching your financial and life goals will take some work, but we’ll provide you with the advice and ongoing support you need to transform your financial life. We look forward to putting our financial planning process to work to help you move towards the financial future you’ve envisioned!

Clarissa R. Hobson, CFP®

Director of Financial Planning

This document is for informational purposes only and does not constitute financial planning advice. Your financial goals are unique to you, so we encourage you to consult with a financial planning professional to ensure your individual needs are considered. Comprehensive Financial Planning is available to clients under a separate agreement.